When tech is changing the world. Is it really for the Board??

We held another insightful discussion amongst a network of international board members in the Digoshen Board Network from countries as Australia, Qatar, Austria, Romania, UK, Belgium, Netherlands, Norway, Finland, Sweden and Denmark, on the topic of ”Boards role in modern Strategy Work”.

We were fortunate to get the framing established by the experienced Board Chair Ingvild Huseby, building on a previous webinar with an introduction of the topic.

A recap from the previous webinar established a joint perspective, from the webinar 7th of April 2021. Long term values are created by those that can renew their business and operational models.

Creating long term values seems to require the company’s ability to renew their business model, alongside delivering short term return on the existing model. New revenue and changed operational models will be a prerequisite for companies that shall survive 10 years anniversary in the future.

Average life span for companies is dramatically reduced – future is enabled by technology. By 2027, the average tenure of Companies is expected to be 12 years from 32 years in 1964 and 32 years in 2016. Data driven companies conquers the top 12 companies (market cap). Company valuation moves towards data driven business models. Company’s data as an asset becomes key, tech innovation the highway to long term value creation.

Treat your data as you treat the cash! Data may become your most valued asset. Collect, grow value, and generate x times return.

New generation of investors requires 3 x P’s (purpose, people, product). Sustainability becomes a pre-requisite to operate and will be regulated by law. Global challenges will be addressed by tech innovation and global collaboration will be through dramatically different value chains – enabled by digital. Transparency increases.

Tech innovation becomes the way to long time values for all stakeholders.

Are your Board on top of future business model(s)? Interesting from McKinsey – Share of 30 top companies —all among the top three in their industry as measured by total economic profit captured between 2015 and 2019—represent the vanguard of an increasingly winner-takes-all world. For Boards it may mean securing measures and focus for company purpose, speed, talent, build for scale, growth through eco-system and data rich tech platforms. Bold moves on purpose, talent and eco-system generates proven results!

Board work increases in complexity. Boards needs to secure the right CEO, challenge status quo and direct for future, keep oversight on both shareholder and stakeholder agenda, short and long term. A balance between past, future and present must be handled and properly communicated. A survey amongst CEO, Chairs and Board Members in Norway in 2019 clearly showed that CEO’s requests support from their Board on future but does not get it!

How can Boards organize the strategy foresight and innovation process when future may be riskier than regulation, or regulation put business future at risk? All executives know that strategy is important. Almost all also find it scary, because it forces them to confront a future they can only guess at. Worse, choosing a strategy entails making decisions that explicitly cut off possibilities and options. An executive may well fear that getting those decisions wrong will wreck his or her career.

Disruption, not regulation, should be future data companies’ top concern. Companies and CEO’s needs competent support from their Board on future!

A strategy foresight agenda becomes crucial – challenging the future and addressing business model risk and opportunities.The agenda may permeate all Board work, from the strategic process, the regular agenda, and in and across the committees. Including outlining areas for “blitz-scaling”, “speed-boats”, invite outsider and increased future customer understanding, and the more bold and somewhat risky moves to be tested.

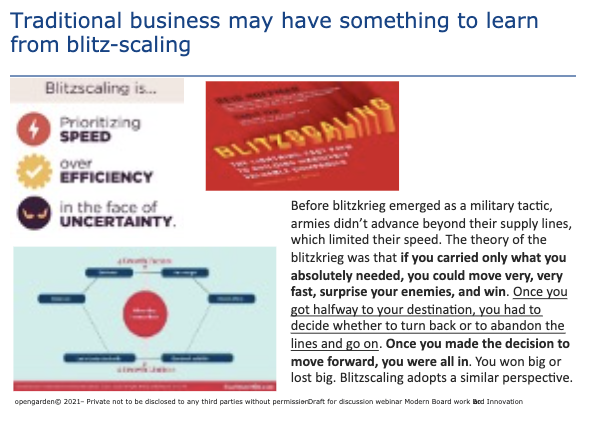

The theory of the blitz-krieg was that if you carried only what you absolutely needed, you could move very, very fast, surprise your enemies, and win. Once you got halfway to your destination, you had to decide whether to turn back or to abandon the lines and go on. Once you made your decision to move forward, you were all in.

Traditional businesses have something to learn from blitz-scaling. The lightening-fast path to building massively valuable companies – speed-boats – your future valuation may depend on your ability to pick some parts of your business for change, scale, and test.

Questions for the process may be:

1) Has your Company (where you sit as Board) identified the most important disruptive areas in 2-5 years’ time?

2) In my Company (where I sit as Board) we have identified the three next speedboats for innovation.

A first poll with the participants identified the most disruptive areas as acknowledged by boards to be New Customer business models, Data Insights, Technology Innovation and Cyber Risks.

The following poll explored the boards experiences and initiatives on working in agile strategy mode, and found that the majority did not yet explore the speedboat approach to revisit strategic areas.

Following the poll the participants discussed topics as

- How can strategy and innovation be organized on the board agenda?

The majority of participating board members had increased their engagement in the strategy development process and used several different approaches. Most had ended up with engaging more with the purpose definition, revisiting the overall strategy, but also moving strategic areas to revisit and debate at most board meetings. Some used strategy advisor support and some used advisor boards to increase the insights. Most had not yet moved into a structured approach to include innovation in the business strategy nor to monitor the company’s innovation process.

- Any/what committees should handle future risk, opportunity and innovation?

The majority of participating board members had still mostly the traditional audit committee as he only one, but had started to work with more temporary committees and temporary initiatives to more quickly handle both crisis, M&A and strategy revisits. Most participants found it to be worth reconsidering to potentially have a strategy/tech /innovation committee or temporary committee that would work to prepare the issues for better, faster and more insightful debate in the full board.

The chair Ingvild Huseby made some concluding remarks. “All the banking people knew the rules, that prevented them from trying anything like PayPal”. Planning feels better, feels less risky vs disrupt that is filled with un-security and fear. Nature is conservative and will strive to go back to where it was before, the “normal”. New normal requires disruption, radical change, and new structures. The next gen strategy foresight process challenges the traditional deep analytical research as a basis for the future – moving towards a simpler rough-and-ready process of thinking through what it would take to achieve what you want and then assessing whether it is realistic to try.

Strategy foresight and business model risk and opportunity must get increased focus in the Board room challenging status quo and should permeate Board and committee work cross past, present and future.

The summary of the framing above was contributed by Ingvild Huseby. Ingvild has close to 30 years of operational experience heading tech growth vehicles B2B. She has 18 years as non-executive Board of Director, 7 years as Chair, and works as an industry specialist and non-executive chair and board member for midmarket growth companies. Her focus is on strategy and M&A processes, building new business models utilizing tech data industry expertise. Key industry expertise is TMT, IoT, utilities, AI, security, technology, logistics/supply chain and business services.

___________________________________

Next Open Exchange will be held on September 1, at 8-9 CET with the focus on “Boards Leadership under Uncertainty”, the webinar is open to participants with an active board mandate.

Sign up to join the Digoshen Exploring Leaders Lobby and register to join the webinar here

___________________________________

Learn more from Digoshen Exploring Leaders

If you are a practicing board member that want to find a safe ground to discuss the board’s guidance of corporate renewal, we welcome you to join our Open Live Sessions:

Digoshen International Live Sessions.

The Live International Board Exchanges are free and open to practicing boards members.

Find our >> upcoming Free Digoshen International Live Session

This blogpost is shared both on the blog of Digoshen, www.digoshen.com, and on the blog of the Digoshen founder www.liselotteengstam.com .

At Digoshen we work hard to increase #futureinsights and help remove #digitalblindspots and #sustainabilityblindspots. We believe that Companies, Boards and Business Leadership Teams need to understand more of the future and the digital world to fully leverage the potential when bringing their business into the digital age. If you are a board member, consider joining our international board network and master programs.

To understand where you and your company stand in relation to digital business and leadership progress, take our survey at Digoshen.com/research and get a free of charge personalized report with recommendations on how to move forward. The survey is anonymous and takes about 15 minutes to complete.

You will find more insights via Digoshen Website and you are welcome to follow us on LinkedIn Digoshen @ Linkedin and on twitter: @digoshen and founder @liseeng